Tax Brackets 2025 Federal Married Joint. “married filing jointly” combines income,. Taxable income and filing status determine which federal tax rates apply.

Tax Filing 2025 Usa Latest News Update, Rate married filing jointly single individual head of household married filing separately; 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

How Trump Changed Tax Brackets And Rates Stock News & Stock Market, This includes the education tax. 10+ 2025 california tax brackets references 2025 bgh, the federal inflation factor is 4.7% for 2025.

Tax Season Guide Married Filing Jointly vs. Separately Chime, The width of the first three tax. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file.

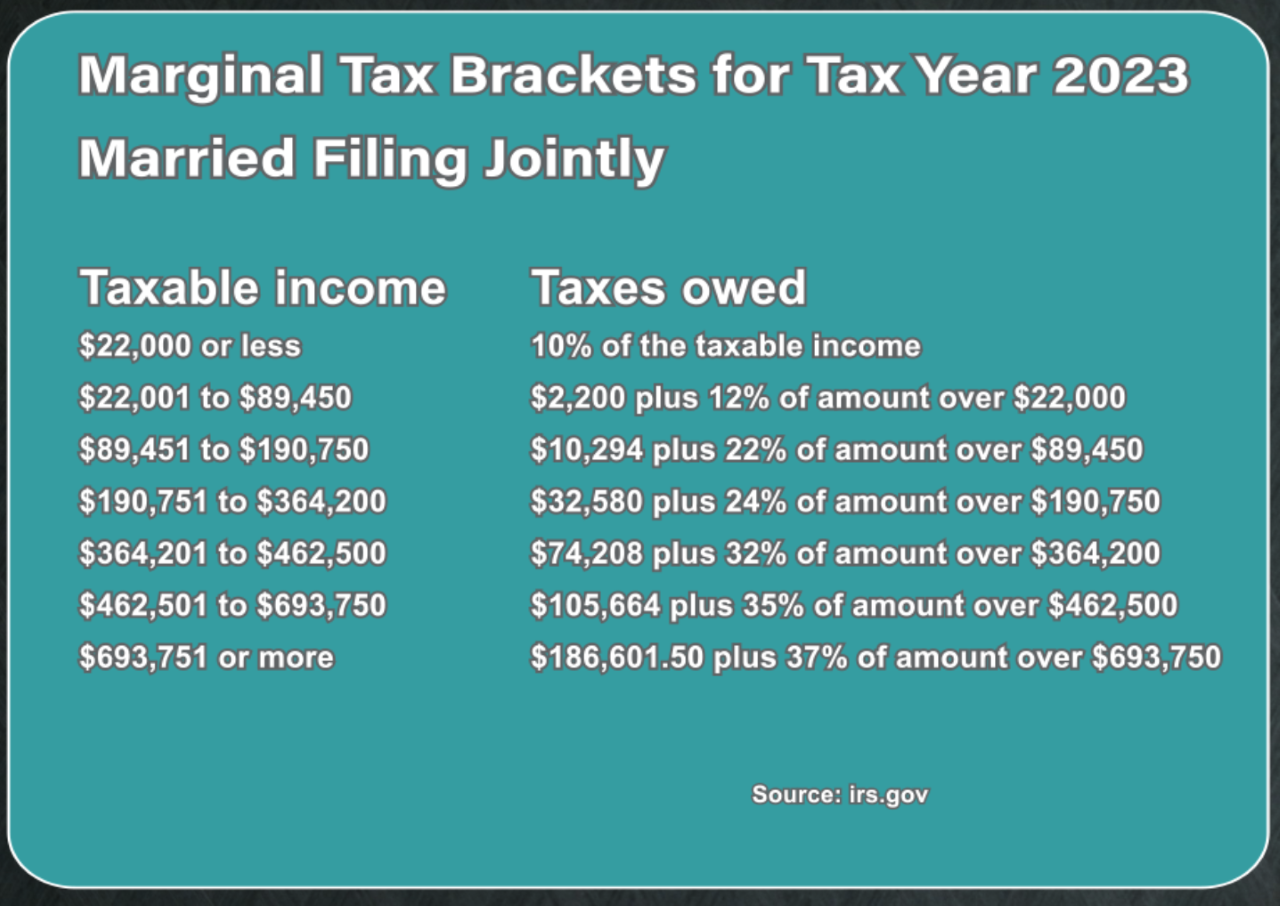

Federal Tax Brackets 2025 Jodee Lynnell, Tax brackets for married filing jointly in 2025. You pay tax as a percentage of your income in layers called tax brackets.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, This includes the education tax. If you’re wondering what your top 2025 california and federal taxes rates are,.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, In 2025, the top tax rate of. “married filing jointly” combines income,.

IRS Tax Brackets AND Standard Deductions Increased for 2025, Looking ahead to the tax year 2025, the tax brackets are anticipated to be adjusted further to account for inflation and. If you’re wondering what your top 2025 california and federal taxes rates are,.

Us tax brackets disneyrety, 10+ 2025 california tax brackets references 2025 bgh, the federal inflation factor is 4.7% for 2025. And is based on the tax brackets of.

The Ultimate Tax Guide How the USA taxes married couples, 2025 federal income tax brackets. Married filing jointly tax brackets 2025 2025 hope, tax brackets for tax years 2025 and 2025.

IRS Announces Inflation Adjustments to 2025 Tax Brackets The Economic, For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Taxable income 2025 taxtaxable income (single) payable amount (married filing jointly) 10% up to $11,600 10% of the taxable income 10% up to $23,200 10% of.